“In the 12 months since the government first made its investment in BofA, our company originated $760m in new credit.”This is a ridiculous result given that government has earned USD 3.6bn in dividends for its one year-investment in BofA. This case clearly documents that although government capital injections may be necessary, they are by no means sufficient to kick-start new business lending and the economy. Success crucially depends on the terms of the government's assistance.

Ph.D. programme on global financial markets and international financial stability at Jena University and Halle University, Germany

Samstag, 5. Dezember 2009

Government bailout plans failed to kick-start lending

Freitag, 13. November 2009

Chinas Notenbankchef ...

Spätestens seit Zhou in einer Rede im März eine Reform des internationalen Währungssystems anmahnte, um eine Wiederholung der Finanzkrise zu vermeiden, achten Politiker, Banker und Investoren in aller Welt auf seine Worte. In seiner Einlassung hatte der Sohn eines ehemaligen chinesischen Industrieministers und einflussreichen Kaders nicht weniger getan, als den Dollar als Weltreservewährung in Frage zu stellen. mehr...

Mittwoch, 11. November 2009

Währungskörbe sind in Mode

Chinas Notenbank stellt wenige Tage vor dem Antrittsbesuch von US-Präsident Barack Obama einen Kurswechsel in ihrer Währungspolitik in Aussicht. Die Zentralbank signalisierte, den Kurs des Yuan künftig an einem Devisenkorb zu

messen, und deutete damit eine Abkehr von der De-facto-Anbindung an den Dollar an, die seit Mitte 2008 in Kraft ist.

Montag, 9. November 2009

Aus geg. Anlass ...

Den Anfang macht dabei unvermeidlicherweise eine Debatte (wieder mal) des Pro und Contra der Wiedervereinigung und vor allem der Währungsunion. Die Meinungen reichen von "katastrophal gelaufen" (Unverdauter Schock von Thomas Fricke) bis hin zu "im Grund ganz gut gelaufen" (Der Erfolg im Osten von Werner Plumpe). Bei Ökonomen - so meine subjektive Einschätzung - überwiegen eher die skeptischen Urteile, wobei man sich typischerweise an der schnellen Einführung der DM in der DDR und an den Folgen der 1:1-Konversion von Ost- und Westmarkt abarbeitet: Einführung der DM: Kohls großer Fehler (FTD)

Meine erste These dazu lautet: Ohne die Wiedervereinigung & Währungsunion (W&W) wäre kein weiterer Fortschritt der europäischen Einigung möglich gewesen. Und zwar darum:

- Die meisten Probleme der (heutigen) neuen Bundesländer wären auch ohne W&W aufgetreten. Dazu zählen auf jeden Fall die Abwanderung und auch die Deindustralisierung.

- Stabilität in der Mitte Europas wäre mit einem politisch, wirtschaftlich und währungsmäßig geteilten Deutschland nicht möglich gewesen. Und ohne Stabilität in der Mitte gibt es keine europäische Stabilität schlechthin.

Deshalb mein persönliches Zwischenfazit: Wiedervereinigung und Währungsunion haben zwar nicht zur besten aller Welten à la Dr. Pangloss alias G. W. Leibniz geführt, doch sie haben wichtige Stolpersteine aus dem Weg geräumt, die den Fortgang der europäischen Einigung ansonsten be- oder gar verhindert hätten.

Freitag, 6. November 2009

Congress about to pass derivatives legislation

Dienstag, 3. November 2009

Der IWF verkauft Gold

Zur Aufstockung von Finanzmitteln hat der IWF fast alles möglich getan: Allokationen der allgemeinen und einmaligen Sonderziehungsrechte (SZR), Emission der IMF-Anleihen. Nun ist der Goldverkauf. Nach der Angabe des IWF gestern werden 200 Tonnen IWF-Goldreserve an die Reserve Bank of India verkauft, siehe" IMF Announces Sale of 200 metric tons of Gold to the Reserve Bank of India."

Das macht 6.7 Mrd.$ , entspricht 4.2 Mrd. SDR. Der Goldverkauf von 403 Tonnen wurde schon im April beim G20-Gipfel geplant, "use the additional resources from agreed IMF gold sales for concessional finance for the poorest countries," so das Londoner Communique.

Donnerstag, 22. Oktober 2009

Dark Pools: Das wurde auch Zeit!

Freitag, 25. September 2009

Pittsburgh: The end of G7

Global leaders will announce Friday that the once elite club of rich industrial nations known as the Group of 7 will be permanently replaced as a global forum for economic policy by the much broader Group of 20 that includes China, Brazil, India and other fast-growing developing countries, the White House said. more...

Donnerstag, 6. August 2009

Obama's Financial Regulation Proposal

Sonntag, 26. Juli 2009

Quantitative Easing - Time to Think About How to Exit

The first pillar is paying interest on bank reserves with the aim of giving banks incentive to redeposit excess liquidity with the Fed instead of letting them push monetary aggregates. It is noteworthy that Bernanke explicitly refers to M1 and M2, not only credit aggregates! Both, paying interest on reserve accounts and looking at monetary aggregates has always been part of the monetary policy framework of the ECB.

The second pillar is curtailing the Fed's balance sheet. For this, Bernanke considers four measures. 1) Reverse repos: they may be suitable if a temporary down scaling is aimed at, but I doubt that it suits if one needs a permanent withdrawal of monetary expansion. 2) The Treasury selling bills and depositing the proceeds with the Federal Reserve: a severe threat to the Fed's independence, without which inflation will be unleashed - it's like casting out devils through Beelzebub. 3) Term deposits: nothing new from a European perspective. 4) Sale of long-term securities into the open market: maybe the most natural way of thinking about curtailing monetary expansion, but there is very little experience with block sales of that size and with these market segments in question.

On of the most interesting questions is whether inflation is more of a problem in the US than in the Euro area. To find an answer one should recognize that 1) monetary policy has been more expansive in the US, and 2) the tools needed to curtail monetary expansion have been already available to the ECB from the outset, so that market participants are more experienced with them in the Euro area than in the US.

Freitag, 10. Juli 2009

Expanding regulatory power of central banks

From an economist's point of view it is still an open question how financial stability and macroeconomic stability are interlinked and whether a central institution should be in charge of both.

Donnerstag, 25. Juni 2009

Timelines of the Global Financial Crisis

- Financial Turmoil Timeline (showing market events, Fed policy actions and other policy actions)

- International Responses to the Crisis Timeline (showing bank guarantees, liquidity and rescue interventions, "unconventional" monetary policy and other market interventions.

Thanks go to Manfred Jäger @ Institut der deutschen Wirtschaft Köln for these links.

PS: And here the same from the Bank of England: Timeline of Crisis Events.

Mittwoch, 24. Juni 2009

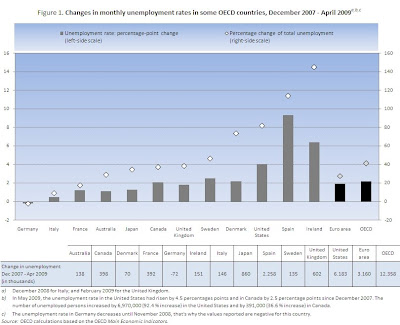

Unemployment in OECD countries to approach 10% in 2010

Source: OECD.

Some may think that Germany, the (former) export world champion, may suffer most from the shrinking world economy. But we are not quite there yet - at least in terms of unemployment.

Freitag, 19. Juni 2009

Vortragsankündigung

Strategic vs. Non-strategic Power in the EU Council: The Consultation Procedure

Ort: Institut für Wirtschaftsforschung, Halle (Lage), Konferenzraum

Zeit: Montag, 22. Juni 2009, 14 Uhr c.t. (Dauer: 90 Minuten)

Interessenten sind herzlich eingeladen.

Professor Widgrens Forschungsgebiete sind (u.a.) die Europäische Integration und hier insb. die EU Entscheidungsverfahren. Dabei verwendet er Methoden der Institutionenökonomik und der Spieltheorie.

Weitere Informationen finden sich auf den Webseiten des Graduiertenkollegs Globale Finanzmärkte und auf Professor Widgrens persönlicher Webseite.

PS: Für Gäste von außerhalb, hier Anreiseinformationen in Form einer Google-Karte, wobei A die Tiefgarage am Hansering bezeichnet, B den Standort des IWH. Fußweg über die Rathausstraße: 5 Minuten.

A small step for the U.S. Congress ...

- More funding for the IMF to help tackle the global crisis under an expanded borrowing arrangement. The United States has committed to increase its credit line by up to an additional $100 billion to the IMF.

- Reform of country representation at the IMF, including greater representation (quotas) for dynamic emerging markets and enhanced voice and participation for low-income countries.

- Go-ahead for the so-called “fourth amendment,” a one-time allocation of Special Drawing Rights (SDRs), an international reserve asset created by the IMF in 1969 to supplement the official reserves of member countries.

- Providing expanded investment authority to the IMF as a key part of a new income model to finance its activities, making it less dependent on earning revenue from interest paid on loans.

- Vote on a proposal for limited gold sales by the IMF, consistent with the agreed framework for the Fund’s new income model. more...

Eine neue Abkürzung: ESRB

ERSB ist das European Systemic Risk Board, was auf Deutsch mit Europäischer Ausschuss für Systemrisiken übersetzt wird. Der Ausschuss wird in Frankfurt bei der Europäischen Zentralbank angesiedelt. Er soll Risiken im Finanzsystem identifizieren, vor Krisen warnen und im Ernstfall Maßnahmen der Krisenbekämpfung koordinieren. Auf der vor wenigen Tagen zu Ende gegangenen Tagung des Europäischen Rats (Brüssel, 18./19. Juni) haben die Briten ihre "Paranoia" überwunden und im Austausch gegen einige Zugeständnisse seitens der anderen Länder die Schaffung dieses zentralen EU-Gremiums für die sog. makroprudenzielle Aufsicht akzeptiert.

Mehr zum Hintergrund dazu bieten folgende Links:

- Reuters beschreibt kurz die Ratsbeschlüsse von Brüssel: ECB-dominated EU financial risk board to pick own chair.

- Für die ganz Wissbegierigen hier die Originalquelle zu den Ratsbeschlüssen: Schlussfolgerungen des Vorsitzes, wo sich auf Seite 6ff die entscheidenden Passagen finden.

- Das Bundesfinanzministerium hat die Problematik im Vorgriff schon ganz gut (und vor allem kurz) zusammengefasst: Starke EU-Finanzaufsicht ist wichtig.

- EZB-Ratsmitglied Lorenzo Bini-Smaghi ordnet die Regulierungsbestrebungen der EU in einen breiteren ökonomischen Rahmen ein: Going Forward: Regulation and Supervision after the Financial Turmoil.

Ein neuer "EU-Kontrollrat"

Mittwoch, 17. Juni 2009

Draft of President Obama's Financial Regulation Proposal

With his regulation plan, President Obama wants to meet five key objectives. Reforms should ...

- Promote robust supervision and regulation of financial firms

- Establish comprehensive regulation of financial markets

- Protect consumers and investors from financial abuse

- Provide the government with the tools it needs to manage financial crises

- Raise international regulatory standards and improve international cooperation

Dienstag, 2. Juni 2009

Collateral damage of the financial crisis: US antitrust law?

Assistant Attorney General for Antitrust Christine Varney claims that the Justice Department can aid economic recovery by prosecuting businesses that have been successful in gaining large market shares. In her announcement last month she argued that "many observers agree" that our current recession reflects "a failure of antitrust" and "inadequate antitrust oversight." ...Professor Priest disagrees:

What does Ms. Varney propose as an alternative approach? [...] Her basic proposal is to transform American antitrust law to more closely resemble that of Europe. She states that American antitrust policies have "diverged too frequently" from those of the Europe, and that "[w]e will focus our efforts on working through our previously divergent policies regarding single-firm conduct and pursuing vigorous enforcement on the [monopolization] front." more...

This is a huge mistake. The principal reasons American and European approaches to antitrust diverge are that the operative legal standards are different and that the Europeans have not adopted a tradition of rigorous economic analysis. [...] In the U.S. -- Ms. Varney's views aside -- success in competition is rewarded. In Europe it is suspect [...] more...Strong stuff!

Sonntag, 31. Mai 2009

Buy American, or: The stimulus bill and US trade obligations

In the stimulus bill, Congress insisted that federal funds could be applied only to projects that used US-made goods, unless that condition violated US trade obligations. But funds for many of the projects funded by the stimulus are funneled to state officials, many of whom ignore or don't know the details of US trade agreements and insist on US content for fear of losing federal windfalls. The federal government designed the stimulus program and provided the funds to pay for it. In our view, simply because a state official tenders the contract doesn't void the international obligation. The WTO and NAFTA judges would surely agree. more...

Mittwoch, 27. Mai 2009

Publikationshinweis

Die G-20 in London: Twitter-Gipfel oder historische Wende?

Montag, 11. Mai 2009

7th Workshop on Money, Banking, and Financial Markets

The workshop aims at offering a discussion forum particularly for young researchers (PhD students and Postdocs) to present their current theoretical or empirical papers to a competent audience. This year's workshop will take place in Duesseldorf (Germany) on June 8/9, 2009. The program is available here.

Information on earlier workshops in this series can be found here.

Freitag, 8. Mai 2009

European Commission Acts on Hedge Funds

Besides, the proposed directive contains the "usual suspects" which are included in all such rules, such as the command to act honestly, rules to avoid conflicts of interest, and disclosure requirements.

But one rule in particular stands out: art. 13, which contains a rule on firms that repackage loans into tradable securities or other financial instruments. What is meant thereby are the notorious Asset-Backed Securities (ABS) or Collaterized Debt Obligations (CDOs). According to the proposed rule, hedge funds managers will only be allowed to invest in such securities if the originator of the securitization process retains a "net economic interest" of no less than 5%. Details will be spelled out by implementing measures to be adopted by the Commission. This rule seems somewhat misplaced in the directive, because it deals with problems that are not directly connected to hedge funds and their managers. It is a kind of indirect regulation of ABS and CDOs, which uses hedge fund managers as an anchor instead of the originators, which often sit in other countries. One can doubt whether this is the appropriate way of limiting the risks that these instruments present.

As was to be expected, the proposal has met with criticism by the industry. For instance, the Bundesverband Alternative Investments (BAI) has cautioned against an isolated European approach. It remains to be seen whether the proposal will be adopted as EC legislation.

Montag, 4. Mai 2009

The return of the Jedi

Incidentally, around the same time this saga started its lasting success, Paul Volcker became chairman of the Federal Reserve. He successfully started to fight inflation (after others made a couple of half-hearted attempts). It was very costly, and - more importantly - it could had been avoided by Volcker's predecessors if they only had considered the long-term consequences of what they were doing in their attempts to prevented the public from seemingly wrong decisions (just like Anakin Skywalker, called Darth Vader, did).

Allan H. Meltzer, a distinguished Monetary Historian, writes in a NYT piece that this lesson has not been well learned by U.S. policy makers and hence, in contrast to the Star Wars saga, the evil is not beaten for good. He claims that economic policy, both fiscal and monetary, are heavily inflationary and that the cost of this policy will come, sooner or later.

[...] no country facing enormous budget deficits, rapid growth in the money supply and the prospect of a sustained currency devaluation as we are has ever experienced deflation. These factors are harbingers of inflation.He incuses policy makers, both at the Fed and Congress, to sacrifice the independence of the FED which simply has become the monetary arm of the treasury. It is the same independence that Paul Volcker had to fight for, and which was necessary to achieve the goal of lowering inflation rates.

Meltzer also argues that deflation is certainly not the problem, even though headline consumer price inflation approaches zero:

Some of my fellow economists, including many at the Fed, say that the big monetary goal is to avoid deflation. They point to the less than 1 percent decline in the consumer price index for the year ending in March as evidence that deflation is a threat. But this statistic is misleading: unstable food and energy prices may lower the price index for a few months, but deflation (or inflation) refers to the sustained rate of change of prices, not the price level. We should look instead at a less volatile price index, the gross domestic product deflator. In this year’s first quarter, it rose 2.9 percent — a sure sign of inflation.Finally, Meltzer is not a friend of deficit-financed government programs.

It doesn’t help that the administration’s stimulus program is an obstacle to sound policy. It will create jobs at the cost of an enormous increase in the government debt that has to be financed. And it does very little to increase productivity, which is the main engine of economic growth.His argument goes further:

[...] big, heavily subsidized programs are rarely good for productivity. Better health care adds to the public’s sense of well-being, but it adds only a little to productivity. Subsidizing cleaner energy projects can produce jobs, but it doesn’t add much to national productivity. Meanwhile, higher carbon tax rates increase production costs and prices but do not increase productivity. All these actions can slow productive investment and the economy’s underlying growth rate, which, in turn, increases the inflation rate.In this respect, Meltzer hopefully errs.

Sonntag, 3. Mai 2009

Chiang Mai Initiative beschließt Krisenfonds für Asien

The objectives of Chiang Mai Initiative Multilateralisation (CMIM) are (i) to address the short-term liquidity problem in the region and (ii) to supplement the existing international financial arrangements. ... The total size of the CMIM is USD 120 billion with the contribution proportion between ASEAN and the Plus Three countries <d.h. China, Japan, Südkorea (MK)> at 20:80. mehr...

Mittwoch, 29. April 2009

Joseph E. Stiglitz: The Seven Deadly Deficits

Die Ursache, warum das Publikum zu weing Wert auf das Wachstum der Difizite gelegt hat, liegt nach der Meinung Stiglitz in zwei Hypothesen:

"The first is that they simply trusted in supply-side economics—believing that, somehow, the economy would grow so much better with lower taxes that deficits would be ephemeral.The second theory is that by letting the budget deficit balloon, Bush and his allies hoped to force a reduction in the size of government."

Anschließend hat er der Obama-Regierung zwei Maßnahmen vorgeschlagen: Steuererhöhung und Senkung der staatlichen Ausgaben.

Dienstag, 28. April 2009

IWF plant eigene Anleihe

Der IWF würde damit ein Stückchen mehr wie die Weltbank, die sich schon länger über Anleihen an den internationalen Kapitalmärkten finanziert. Der IWF dagegen hat sich traditionell aus direkten Einzahlungen seiner Mitgliedsländer finanziert.

Sonntag, 26. April 2009

Das Ende des Washington Consensus?

... the “Washington Consensus” about how the global economy should be run is now a thing of the past. ... the Obama administration is clearly moving towards the kind of government intervention that China has been promoting over the past two decades. In this model, the government, while continuing to benefit from the international market, retains power over the economy’s “commanding heights” through strict control over the financial sector, restrictive government procurement policies, guidance for research and development in the energy sector, and selective curbs on imports of goods and services.

...

As the US backtracks on its liberal standards, it is flirting with what can be called the “Beijing Consensus”, which makes economic development a country’s paramount goal and prescribes that states should actively steer growth in a way that suits national stability. What matters in this worldview is not the nature of any country’s political system, but the extent to which it improves its people’s wellbeing. At the diplomatic level, this implies that national interests, not universal norms, should drive co-operation. mehr...

Starker Tobak!

PS: Als Abrundung hier Hintergrundinformationen zum Washington Consensus.

Freitag, 24. April 2009

China: Goldene Zeiten?

China revealed on Friday that it built up its gold reserves by three quarters since 2003, making it the world’s fifth largest holder of bullion. The move comes as European central banks continue to sell their gold and the International Monetary Fund has discussed selling some of its bullion reserves.

Und:

China is really looking at a lot of other options to get away from the U.S. dollar. The latest report is that it has been building huge gold reserves. There is no doubt that China wants to get out and away from the U.S. dollar now. We have heard SDRs, copper and precious metals all mentioned as plays out of U.S. dollars. How this will play out on currency markets and in the U.S. government bond market is no at all clear. mehr...

Donnerstag, 23. April 2009

Neue Webseite mit Wirtschaftsdaten der G20

Initiator der neuen Webseite ist (wie die Bundesbank meldet) die Inter-Agency Group on Economic and Financial Statistics. Sie wurde Ende 2008 ins Leben gerufen und setzt sich aus Vertretern der Bank für Internationalen Zahlungsausgleich (BIZ), der Europäischen Zentralbank (EZB), von Eurostat, des Internationalen Währungsfonds (IWF), der Organisation für wirtschaftlicheZusammenarbeit und Entwicklung (OECD), der Vereinten Nationen (UN) sowie der Weltbank zusammen. Den Vorsitz führt der IWF.

Vgl. dazu auch die Pressemeldung des IWF: Inter-Agency Group on Economic and Financial Statistics Launches G-20 Statistical Website

Mittwoch, 22. April 2009

China: Aus dem Dollar-Dilemma ?

1. Vorschlag einer neuen Leitwährung anstatt Dollar

Zhou Xiaochuan, der Chef der Chinas Zentralbank ,hat eine umfassende Reform des internationalen Währungssystems und langfristig eine Ablösung des Dollars als weltweite Leitwährung geforder. ......Mehr

Wen Jiabao, der chinesischer Ministerpräsident, hat in der Jahrestagung des Boao Forum for Asia in der Debatte über eine internationale Reservewähurung nachgelegt. Wen Jiabao forderte von denjenigen Ländern, deren Währung international als Reserve betrachtet wird, namentlich von den Vereinigten Staaten, eine stärkere Überwachung ihres Finanzsystems. Zugleich kündigte er an, die internationale Bedeutung der chinesischen Währung Yuan ausbauen zu wollen. ......Mehr

2. Ausweiterung der wirtschaftlichen Zusammenarbeit in Asien

Zheng Xinli, the executive vice chairman of China Center for international Economic Exchanges, hat eine Verstärkung der wirtschaftlichen Kooperation auf dem Boao Forum for Asia aufgerufen. Textauszug:

First, to protect the safety of US Dollar reserves held by countries, Asian countries should join hands to demand that the U.S. make commitments to peg the value of US treasury bonds to the inflation rates of US Dollar.

Second, to promote the reform of international reserve currency system, Asian countries should, based on the Chiang Mai Initiative, explore the SDR as the Asian reserve currency.

Third, to step up the development of Asian countries, it is suggested to establish the Asian Infrastructure Investment Bank and Asian Agriculture Investment Bank. ......Mehr

3. Diversifikation der Investionen

"Vorsitige Investionen in Eurupa in einem angemessenen Umfang," so sagte der Chef des chinesischen Staatsfonds (CIC) Lou Jiwei am letzten Samstag bei einer Finanzkonferenz in China, "und wir haben hier viele guten Chancen identifiziert.".....Mehr

Zugleich sind die Inverstitionen in Afrika und Südamerika auch wesentlich gestiegen, wobei die meisten in der Energiebranche sind.

Samstag, 4. April 2009

BVerfG sieht europarechtlichen Klärungsbedarf in Bezug auf das Finanzmarktstabilisierungsgesetz

Freitag, 20. März 2009

Freigeld

Dienstag, 17. März 2009

Economics in One Easy Lesson

Heidi is the proprietor of a bar in Berlin. In order to increase sales, she decides to allow her loyal customers - most of whom are unemployed alcoholics - to drink now but pay later. more...

Samstag, 14. März 2009

EZB - Stand halten!

Nachtrag (15.03.2009)

Wenigstens nicht so in der EZB: Lorenzo Bini Smaghi, Mitglied des EZB Rats, sagte

[...] An excessively low level of interest rates may also have some unintended consequences in financial markets. It might drive some financial intermediaries out of business, for example money market funds having small, but strictly positive investment fixed costs and not anymore in the position to offer positive net returns to risk averse investors, thus risking large redemptions.

Dienstag, 10. März 2009

Buy American

Where is this road taking us...?Bank of America has become the first US bank to withdraw job offers made to MBA students graduating from US business schools this summer, citing conditions laid out in its bail-out deal as the reason.

The recently passed $787bn stimulus bill in effect prevents financial institutions that have received money from the government’s troubled asset relief programme from applying for H1-B visas for highly skilled immigrants if they have recently made US workers redundant.

Montag, 9. März 2009

Bounded rationality

Classical theory also tells us that financial markets will also be stable. People will only make trades that they consider to benefit themselves. When entering financial markets – buying stocks or bonds or taking out a mortgage or even very complex securities – they will do due diligence in seeing that what they are buying is worth what they or paying, or what they are selling.In other words: actors in financial markets are only boundedly rational and thus government has the duty to prevent - through appropriate regulation - that they take decisions that could be harmful for themselves, for others and for the market economy as a whole. In brief:

What this theory neglects is that there are times when people are too trusting. And it also fails to take into account that if it can do so profitably, capitalism will produce not only what people really want, but also what they think they want. It can produce the medicine people want to cure their ills. That is what people really want. But if it can do so profitably, it will also produce what people mistakenly want.

It will produce snake oil. Not only that: it may also produce the want for the snake oil itself. That is a downside to capitalism. Standard economic theory failed to take into account that buyers and sellers of assets might not be taking due diligence, and the marketplace was not selling them insurance against risk in the complex securities that they were buying, but was, instead, selling them the financial equivalent of snake oil. more...

It is the role of the government ... to regulate asset markets so that people are not falsely lured into buying snake-oil assets. more...See also Robert Shiller's and George Akerlof's new book on Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism.

Donnerstag, 5. März 2009

Key Issues for the G20

China: Record Budget Deficit

Dienstag, 3. März 2009

The US Deficit in Global Perspective

Conclusion (from the blog):

If the government fails in securing funding, a very high probability of systemic collapse.

Geldpolitik in Zimbabwe

Gegenwart in Vergessenheit zu geraten. In Zimbabwe hat die Inflationsrate dreistellige Millionenbeträge erreicht. Damit verbunden sind Hunger, Cholera und Verfolgung Oppositioneller.

Eine Gruppe mutiger Menschen im Land diskutiert eine Ordnung nach der Regierung Mugabe. Denn eine weigehende Reform unter Mugabe ist kaum denkbar, trotz der Beteiligung der MDC an der Regierung. Dies mag aber anders sein, wenn es um die Geldpolitik geht, denn auch die Regierung zieht keinen Nutzen mehr aus der Inflation. So ist die Währungspolitik ein Gegenstand dieser Diskussion; sogar von außen gibt es Beiträge. Steven Hanke hat zum Beispiel vorgeschlagen, einen Currency Board zu errichten. In einem kurzen Beitrag im Standard (Zimbabwe), Business Day (Südafrika) und VoxEU (http://voxeu.org/index.php?q=node/3153) diskutieren Peter Draper und ich diesen Vorschlag und vergleichen ihn mit Alternativen, nämlich der Übernahme des Rand als Währung in Zimbabwe sowie einer Anbindung des Zim Dollars an den Rand.

Die Currency Board Lösung kann als unrealistisch gelten, da die nötigen Währungsreserven fehlen. "Randisierung", wie von Südafrikas Präsident Motlanthe vorgeschlagen, ist glaubwürdeig, aber politisch nicht attraktiv, so dass wir die Wechslekursfixierung für die gangbarste Lösung halten, aber die "Randisierung" präferieren. Auf jeden Fall muss bald etwas geschehen, damit die Märkte in Zimbabwe wieder funktionieren können.

Samstag, 28. Februar 2009

G20 Website

https://www.g20.org/index.aspx

There is now a public area with publications and other information sources. The website states that

... as Chair of the G20 in 2009 the UK, working closely with Brazil and Korea 2008 and 2010 Chairs respectively, has established four working groups to advance this work for the next Leaders Summit on 2 April in London. Each working group is co-chaired by two senior officials from the G20, one from a developed and one from an emerging market economy. Each G20 country is represented on each working group. Experts from relevant international financial institutions, standard setting bodies, non G20 countries, business and academia have also been invited by co-chairs to input into the work of the groups.The four working groups are

Working Group 1 - Enhancing sound regulation and strengthening transparency

Working Group 2 - Reinforcing international co-operation and promoting integrity in financial markets

Working Group 3 - Reforming the IMF

Working Group 4 - The World Bank and other multilateral development banks (MDBs)

The forthcoming London summit has its own website: http://www.londonsummit.gov.uk/en/

Freitag, 27. Februar 2009

Clear Rules of the Road

Mittwoch, 25. Februar 2009

Did math formula cause financial crisis?

Dienstag, 24. Februar 2009

New Capital Assistance Program for US Banks

Under this program ... the capital needs of the major U.S. banking institutions will be evaluated under a more challenging economic environment. Should that assessment indicate that an additional capital buffer is warranted, institutions will have an opportunity to turn first to private sources of capital. Otherwise, the temporary capital buffer will be made available from the government. <...> Any government capital will be in the form of mandatory convertible preferred shares, which would be converted into common equity shares only as needed over time to keep banks in a well-capitalized position and can be retired under improved financial conditions before the conversion becomes mandatory. Previous capital injections under the Troubled Asset Relief Program will also be eligible to be exchanged for the mandatory convertible preferred shares. more...The new program could result in the nationalization of major US banks, with Citigroup being the first. Cf. the reports in the Washington Post and the New York Times. Paul Krugman argues that nationalization is unavoidable: Isn’t nationalization un-American? No, it’s as American as apple pie. Treasury Sectretary Timothy Geithner disagrees: Nationalization is the wrong strategy.

Sonntag, 22. Februar 2009

Protectionism within Europe

The European Commission, increasingly concerned about protectionist tendencies in member states, has asked France, Spain and, on Friday, Italy to justify their auto sector aid packages.

The EU's executive arm has some concerns over Italy's plan to aid its ailing auto sector and was writing to Rome Friday to seek more details, a spokesman said Friday. The commission will write to the Italian authorities today asking them to provide precise details on the measures within five working days, he added. One particular area of concern is that the government help seems to be available only to businesses that sign a protocol with the government, he said. Such aid could be discriminatory against companies who do not want to sign and in that case it would be state aid because it would be selective and threaten the free circulation of goods, he added. more...

Barroso calls for curb on bankers' bonuses

The payment of excessive bonuses incites financial managers to take ill-considered risks, Barroso told the German daily Hamburger Abendblatt. Rather, a system should be established that curbs the greed to realise quick profits and that doesn't reward failure, he said. The European Commission would examine a proposal to this effect in April or May, he told the newspaper. more...

Samstag, 21. Februar 2009

EU-based central clearing for CDS

The slightly discordant note in this piece of good news is that the agreement seems to refer only to European contracts -- which would contradict the stated intentions of Chancellor Angela Merkel. In Mehr internationale Regeln für Finanzmärkte (also here) she states:Major banks and brokers involved in the credit default swaps industry committed yesterday (19 February) to use EU-based central clearing for their trades, bowing to pleas from regulators to lower the risks of this business which stands accused of worsening the ongoing financial crisis. ...

Credit default swaps are a particular type of credit derivatives aimed at guaranteeing a creditor against the risk of default or delays in getting back the credit. ... The idea of establishing a central clearing house is considered a moderate way to reduce systemic risks related to derivatives. Instead of being exchanged privately ("over the counter", according to the jargon), they will be processed through a third intermediary, which will decrease costs and risks while raising guarantees. ...

Following pressures from the Parliament and the Commission, the main firms active in the market of credit default swaps agreed to use central counterparty clearing for the "eligible" EU contracts by end-July. They confirmed their engagement with a letter sent to commissioner Charlie McCreevy responsible for the EU internal market. The signatories of the letter are Barclays Capital, Citigroup Global Markets, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, J.P. Morgan, Morgan Stanley and UBS, all members of the International Swaps and Derivatives Associations (ISDA). more...

Wir wollen sicherstellen, dass es in Zukunft keine weißen Flecken mehr auf der Landkarte unserer Welt gibt, wenn es um Finanzmarktprodukte geht, wenn es um die Teilnehmer des Marktes geht und wenn es um die Instrumente geht.

Donnerstag, 19. Februar 2009

Hedge Funds As Innocent Bus Crash Victims

Banker-Boni

Aus wirtschaftswissenschaftlicher Sicht macht gerade eine nüchterne empirische Analyse Furore, und zwar die Studie Wages and Human Capital in the U.S. Financial Industry: 1909-2006 von Thomas Philippon (New York University) und Ariel Reshef (University of Virginia). U.a. das Handelsblatt (Banker sind überbezahlt wie schon 1929) und Associated Press (Wall Street's culture of entitlement hard to shake) greifen sie auf. Die Autoren belegen mit ökonometrischen Methoden, dass die Gehaltsentwicklung im US-Finanzsektor nur mit einer anderen historischen Epoche vergleichbar ist: der Boom-Zeit vor der Großen Depression, die mit dem Aktiencrash vom Oktober 1929 endete. O-Ton der Studie:

This finding is prima facie evidence that the financial sector is not in a sustainable labor market equilibrium, and that short term rents are likely to diminish.Klartext: Die Gehaltsentwicklung im Finanzsektor war nicht nachhaltig. Ein beträchtlicher Rückgang der dort erzielten (bzw. erzielbaren) Einkommen ist unvermeidlich.

Doch das Thema hat auch eine ethische Dimension. Offenbar tut sich hier ein Abgrund auf zwischen dem, was für Normalbürger ethisch selbstverständlich ist, und dem, was in der Welt der Investmentbanker als normal gilt. Unter der Überschrift John Thain fällt in Ungnade*/ macht die LA Times dazu eine kluge Beobachtung:

The long hours many bankers work help feed an attitude of entitlement, Freeman said."I've had former students talk about sleeping under their desks," he said. "This leads to this idea of, I'm entitled to being rewarded. But sometimes, that's disconnected from performance."Will heißen: Die 24/7-Kultur, die bei Investmentbankern gepflegt wurde (wird?), führt bei ihnen zu dem Gefühl, die Millionenboni verdient zu haben. Dass sie mit ihrer Arbeit -- der Erzeugung von toxischen Finanzprodukten -- keine oder sogar negative Werte geschaffen haben, passt nicht in ihr Weltbild. Anders gesagt: die Investmentbanker beurteilen sich selbst nach ihrem Input (und der ist enorm), der Rest der Welt beurteilt sie nach ihrem Output - und der ist derzeit negativ.

Und schließlich der juristische Aspekt. Angeblich sind die Boni - da arbeitsvertraglich zugesichert - nicht kürzbar. In seinem Interview Geld des Steuerzahlers nicht für Boni erklärt der Staatsrechtler Otto Depenheuer von der Universität zu Köln, warum dem (nach seiner Ansicht) nicht so ist.

*/ John Thain (früher Merrill Lynch) war 2008 der Topverdiener an der Wall Street: Executive Pay: The Bottom Line for Those at the Top aus der New York Times.

Mittwoch, 18. Februar 2009

Bail out: transatlantic differences

The most interesting thing about this: For members of the Euro area there is no doubt that a bail out will take place once a member has to default (see the statement given by the German Federal Minister of Finance in the final paragraphs of this piece). As for California, a bail out cannot be taken for granted.

Does this imply that markets do not demand bail outs but actually punish them?!

Maybe the answer is that markets expect that California, as the world's economically strongest region, could afford an increase in taxes for paying down its debt, while this option is not available to Euro area countries like Ireland, Spain and Greece...

Gesetz zur weiteren Stabilisierung des Finanzmarktes

Zum Inhalt des Gesetzes heißt es in der offiziellen Vorlage wie folgt:

"Der Entwurf sieht vor allem Anpassungen und Verbesserungen bei den Begleitregelungen im Gesellschafts- und Übernahmerecht vor, damit Stabilisierungsmaßnahmen schnell und effektiv greifen können und Übernahmen zum Zweck der Stabilisierung erleichtert werden. Diese Änderungen gelten nur für Unternehmen, die die Leistungen des Stabilisierungsfonds in Anspruch nehmen oder nehmen wollen. Darüber hinaus schafft der Gesetzentwurf die zeitlich eng befristete Möglichkeit, zur Sicherung des öffentliches Gutes „Finanzmarktstabilität“ Anteile an einem Unternehmen des Finanzsektors und Wertpapierportfolien gegen angemessene Entschädigung zugunsten des Bundes oder des Finanzmarktstabilisierungsfonds zu verstaatlichen. Die Verstaatlichung ist nur zulässig, wenn andere rechtlich und wirtschaftlich zumutbare Lösungen zur Sicherung der Finanzmarktstabilität nicht mehr zur Verfügung stehen."

Aida - nicht von Verdi und auch keine Kreuzfahrt

... Kern des Modells seieine Holding, die nach dem Vorbild der staatseigenen Förderbank KfW von den Vorschriften des Kreditwesengesetzes (KWG) befreit wäre. Diese Holding bildet sozusagen das Dach einer Halle, in der dann die Bad Banks der einzelnen Institute stehen. Sie wären ebenfalls Anstalten des öffentlichen Rechts und damit „Anstalten in der Anstalt“ – kurz Aida. Deshalb heißt das Projekt auch „Aida-Modell“. mehr ...

Dienstag, 17. Februar 2009

In German - Wissenschaftliche Beirat beim Bundeswirtschaftsministerium zur Bankenregulierung in der Finanzkrise

Montag, 16. Februar 2009

IMF Gains New Funding, Puts Focus on Bank Clean Up

Freitag, 30. Januar 2009

Bad Banks: transatlantic differences

Samstag, 24. Januar 2009

"Bad Banks" for Beginners

Montag, 5. Januar 2009

In a nutshell

And what's next?

Update on 30. January: Now it's almost official -- Buy American stimulus ...

Donnerstag, 1. Januar 2009

Should we fear a trade backlash?

PS: Arvind Subramanian (Peterson Institute) weighs in: From Financial Folly to Trade Troubles?