Ph.D. programme on global financial markets and international financial stability at Jena University and Halle University, Germany

Dienstag, 30. Dezember 2008

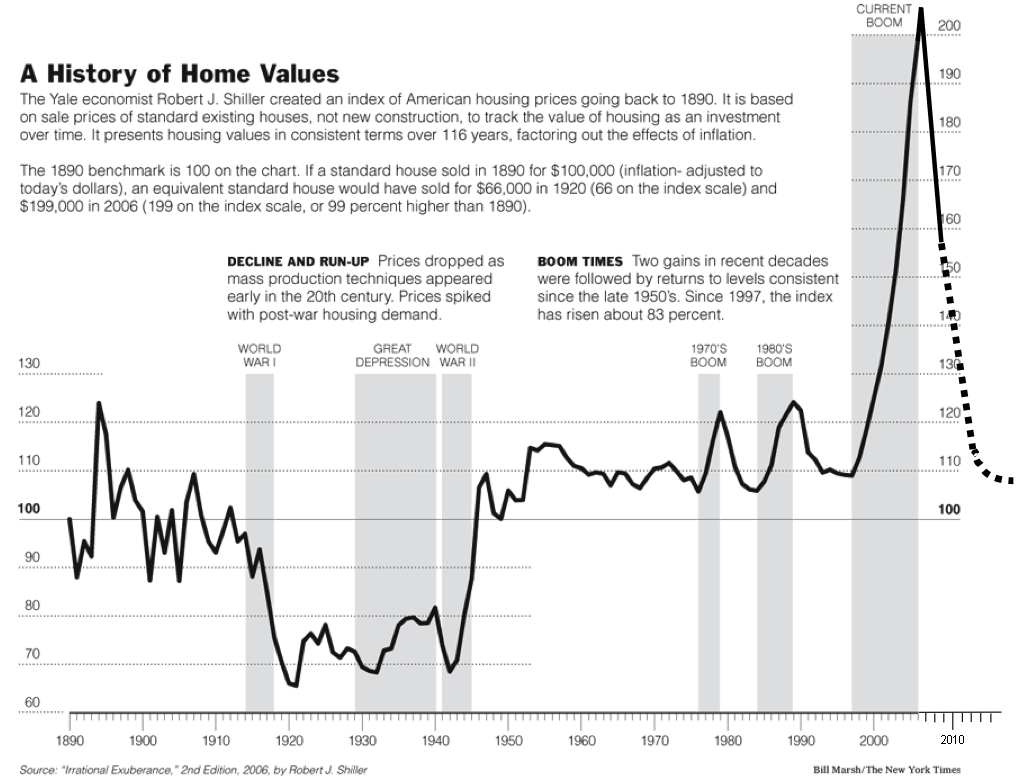

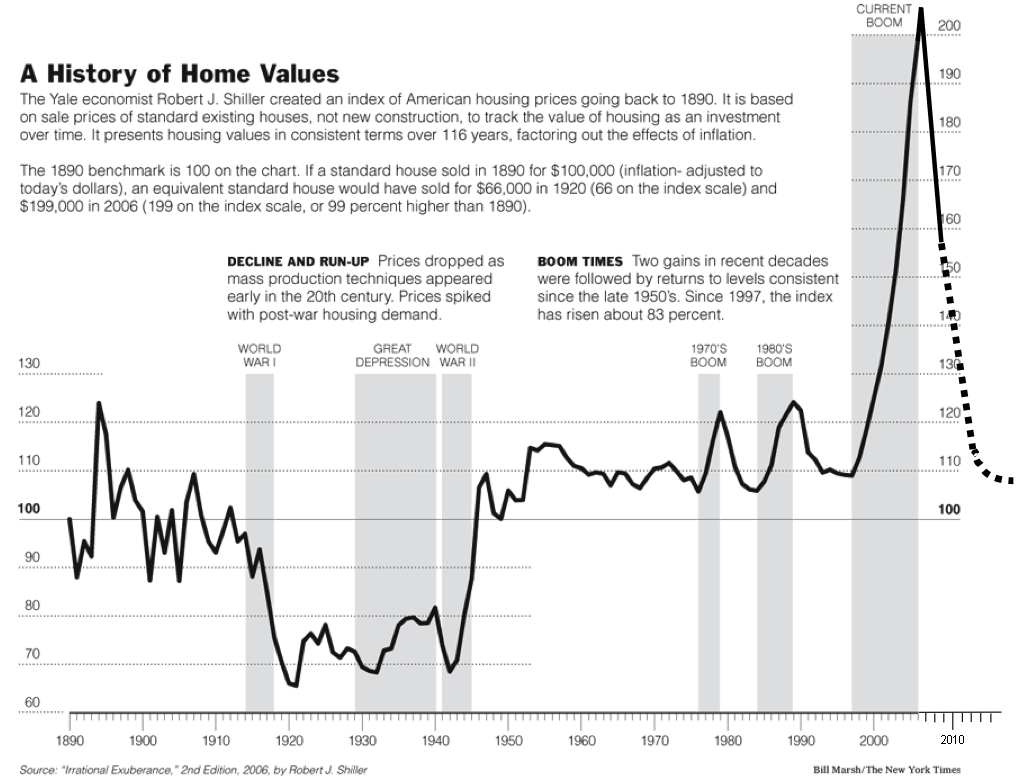

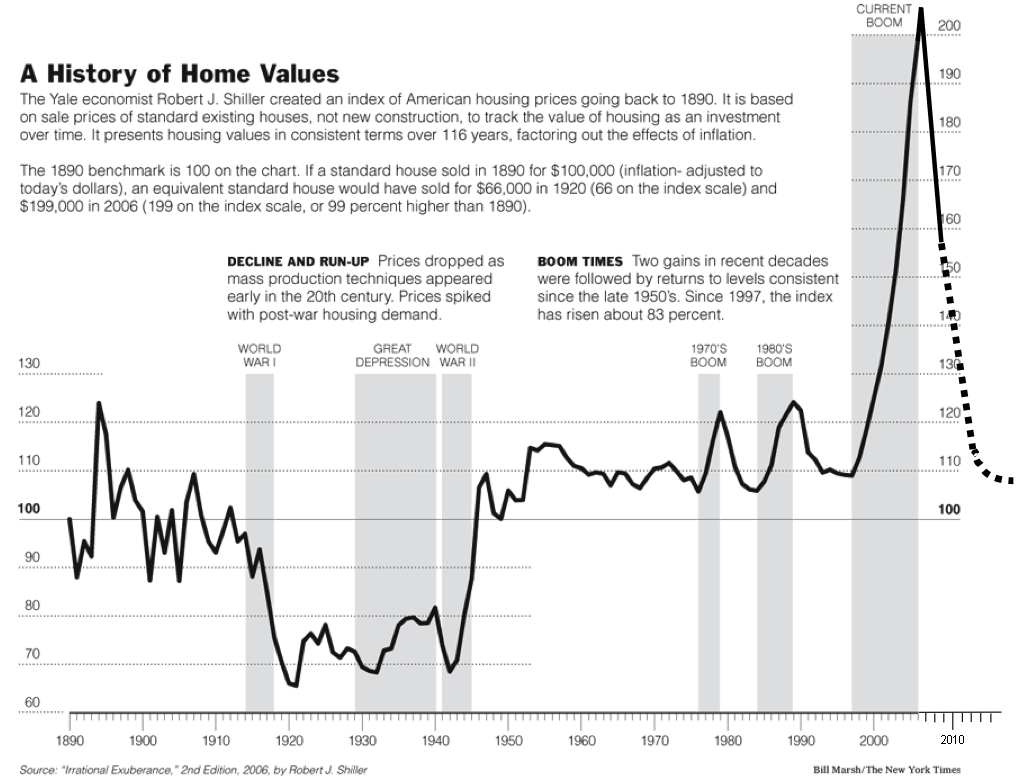

The US housing bubble in historical perspective

Blogger Barry Ritzholtz at The Big Picture presents a diagram with the long-term evolution of US housing prices according to the Case-Shiller index. The diagram shows the extreme overvaluation during the housing bubble that began in the late 90s and burst in 2007. The diagram also suggests that a further massive downward correction is unavoidable during the coming years.

Abonnieren

Kommentare zum Post (Atom)

Keine Kommentare:

Kommentar veröffentlichen